AI-Powered, End-to-End Solutions for Equipment Financing

Automate, Optimize, and Scale Every Aspect of Your Lending Operations

Welcome to QuipSuite, the AI-driven platform tailored for the equipment financing industry.

Our modular solutions streamline your lending process, minimize risk, and enable faster, smarter decision-making. With QuipSuite, you’ll close deals faster, boost customer satisfaction, and drive sustainable growth.

AI-Powered, End-to-End Solutions for Equipment Financing

Automate, Optimize, and Scale Every Aspect of Your Lending Operations

Welcome to QuipSuite, the AI-driven platform tailored for the equipment financing industry. Our modular solutions streamline your lending process, minimize risk, and enable faster, smarter decision-making. With QuipSuite, you’ll close deals faster, boost customer satisfaction, and drive sustainable growth.

Trusted by

- Key Benefits

- ➔ Accelerate Lending Processes: Streamline your lending process end-to-end with automated workflows, reducing bottlenecks and securing deals faster.

- ➔ Enhance Decision-Making: Leverage real-time data insights and seamless system integrations to minimize risk and make informed, confident decisions.

- ➔ Boost Operational Efficiency: Eliminate manual processes, lower operational costs, and improve productivity with customizable, automated solutions.

- ➔Tailored to Your Needs: Configure QuipSuite’s modules and workflows to fit your specific business requirements, ensuring maximum optimization at every stage of the lending process.

Our Solutions

Each of QuipSuite’s modules is designed

to empower your business with tailored solutions:

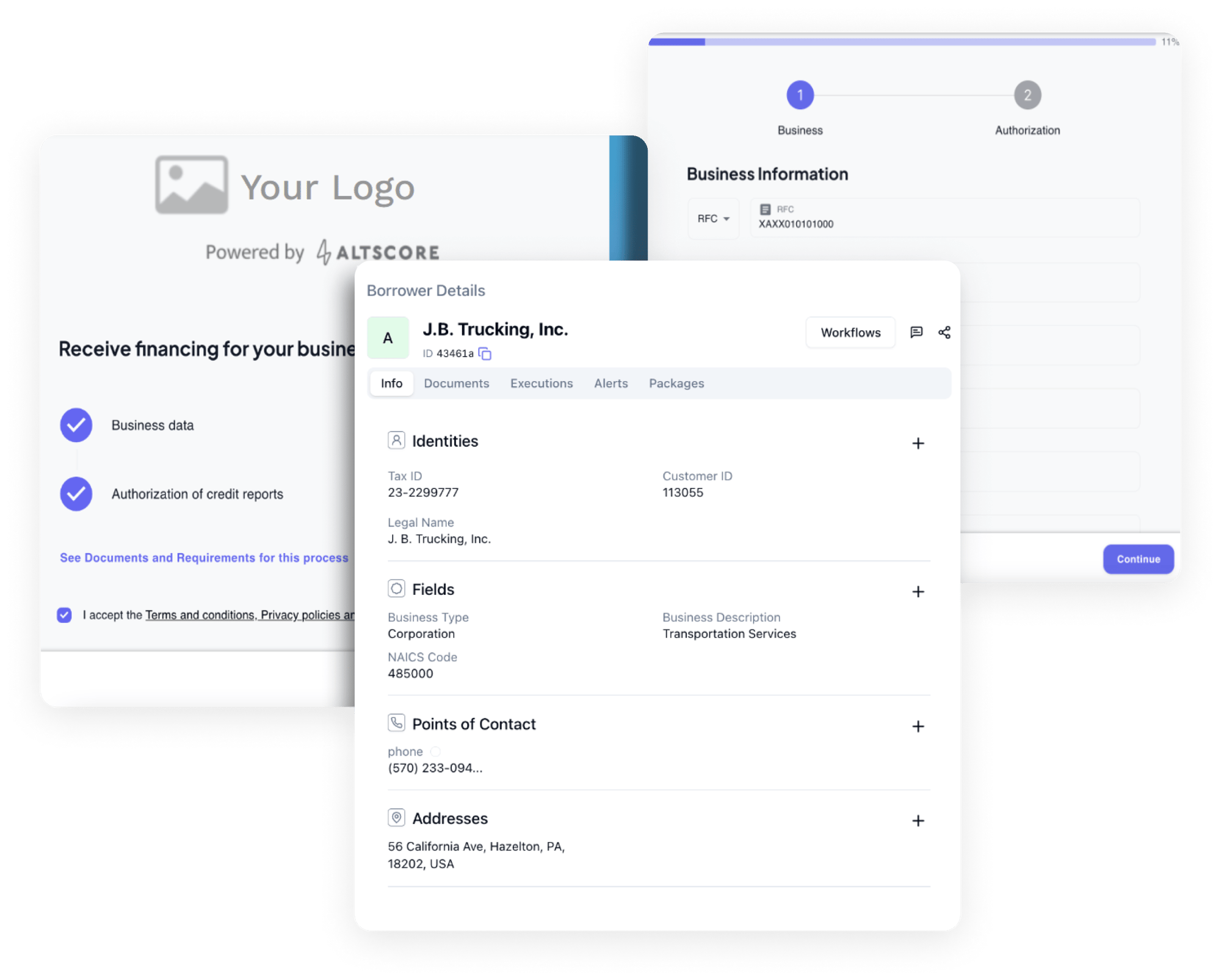

QuipStart

Automated Application Onboarding

Automated Application Onboarding

Automate data extraction from email applications for error-free onboarding, saving you time and reducing manual input, and send it straight to your system.

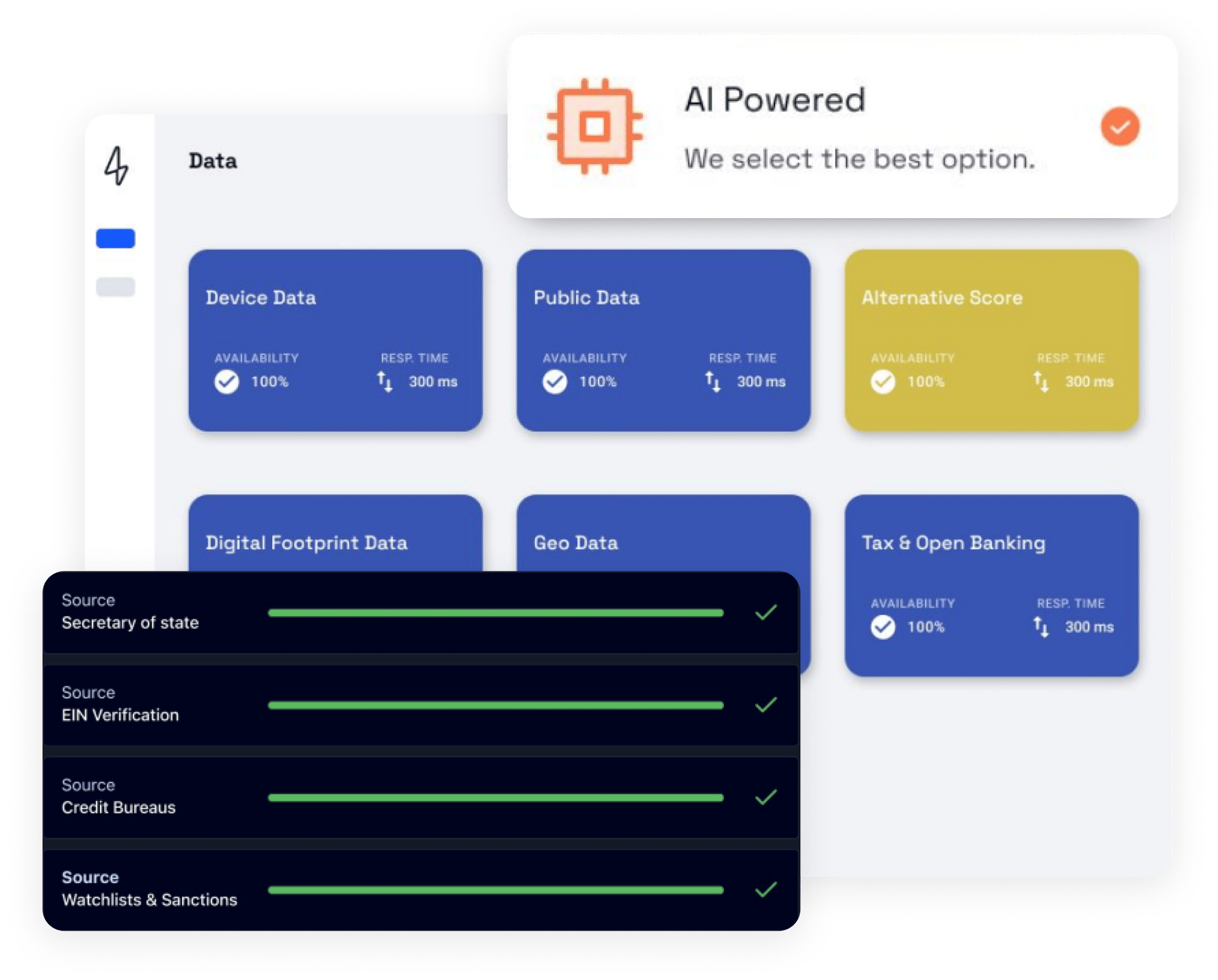

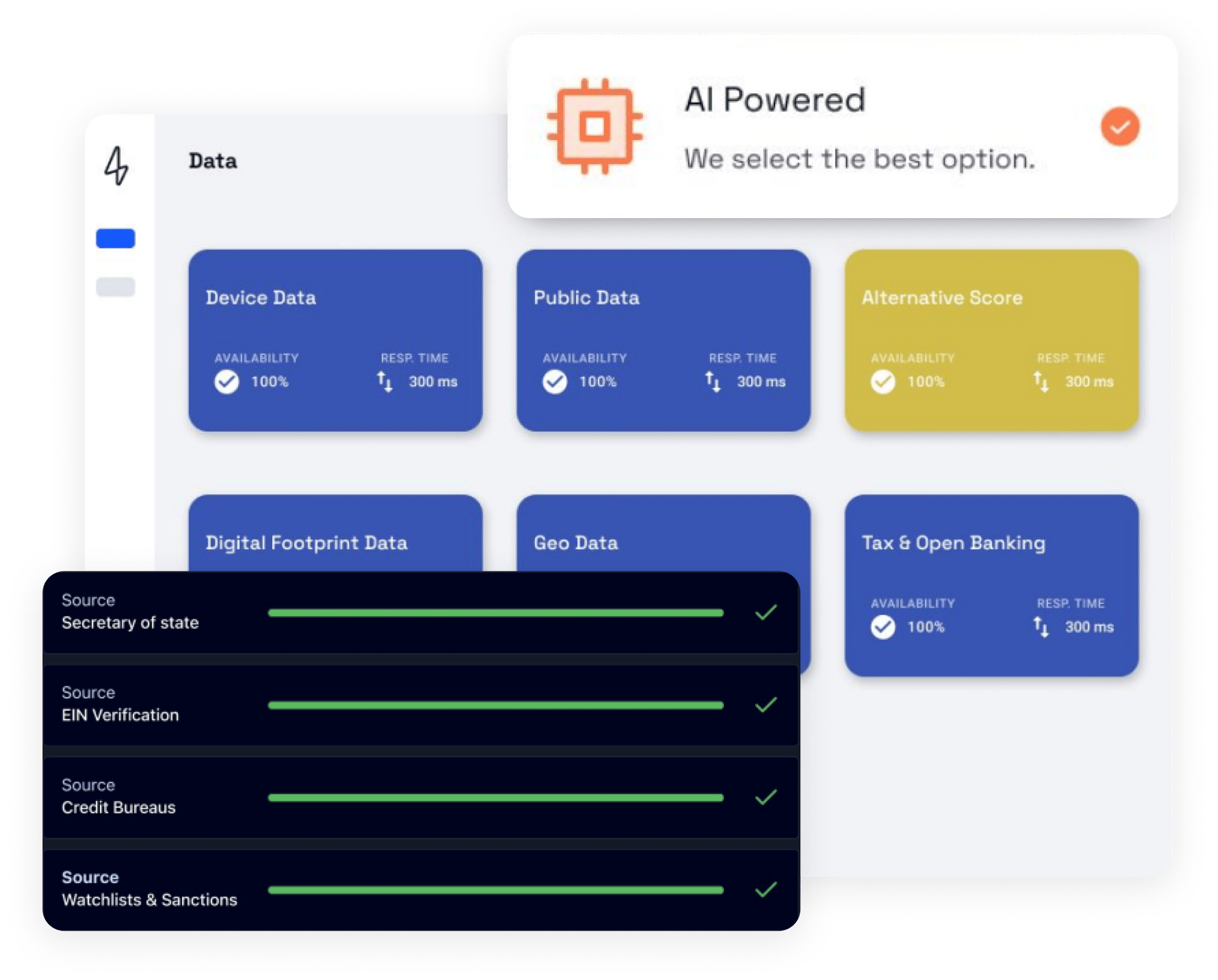

QuipTrust

KYC/KYB + Fraud Prevention Verification

Instantly verify clients with the industry’s top data sources and detect fraud before it happens. Customizable alerts and detailed reports help you confidently manage risk.

QuipTrust

KYC/KYB + Fraud Prevention Verification

Instantly verify clients with the industry’s top data sources and detect fraud before it happens. Customizable alerts and detailed reports help you confidently manage risk.

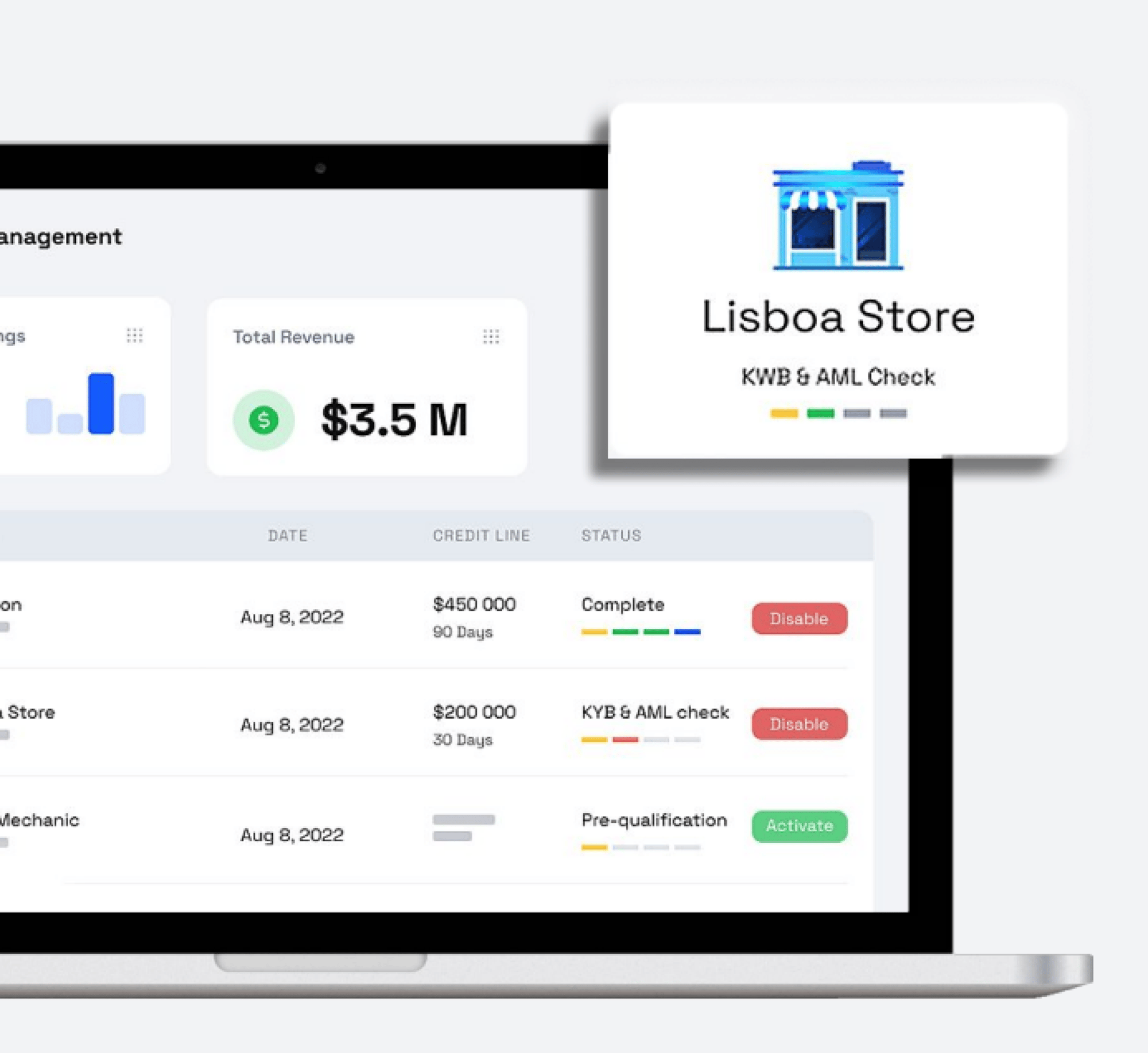

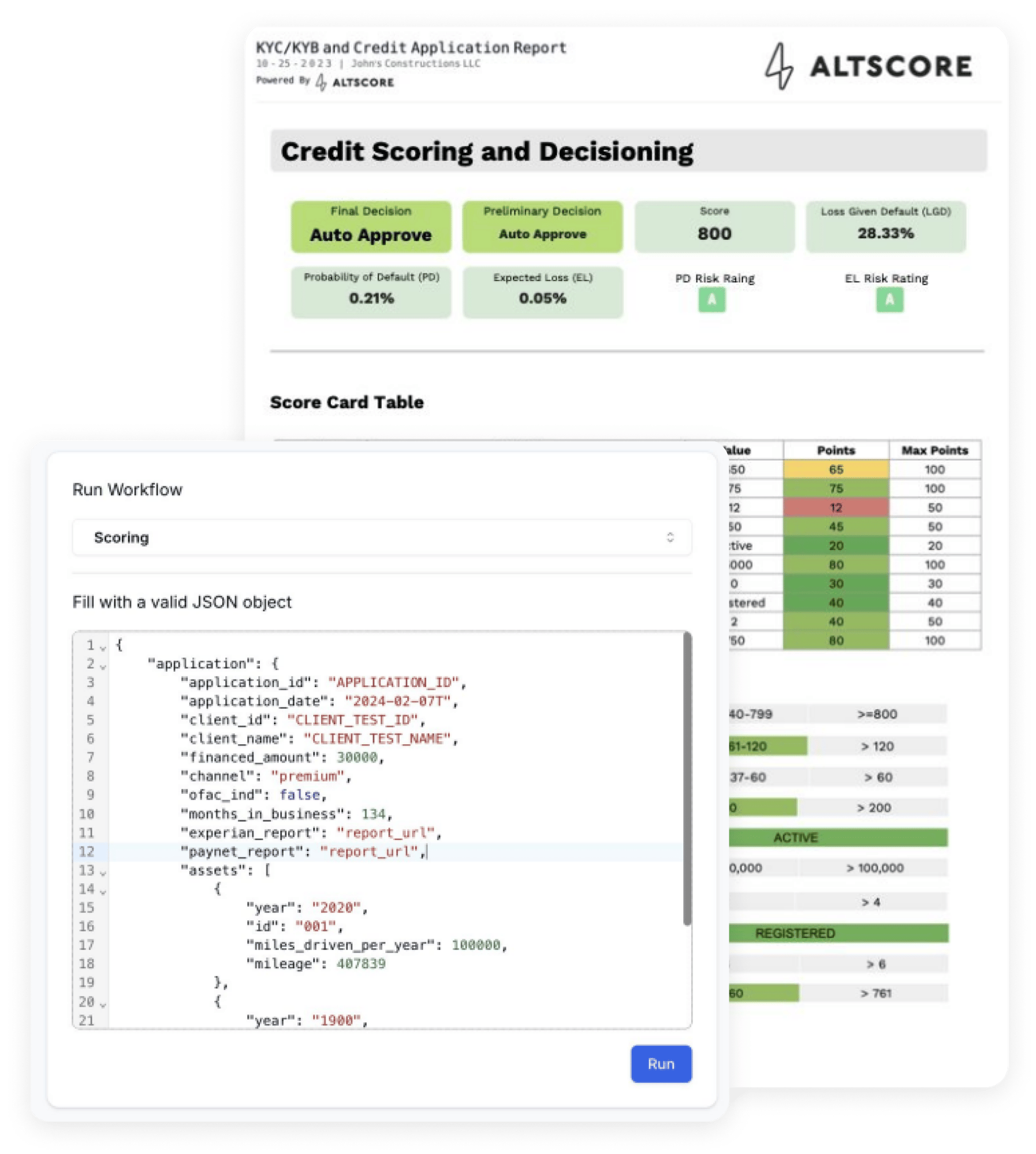

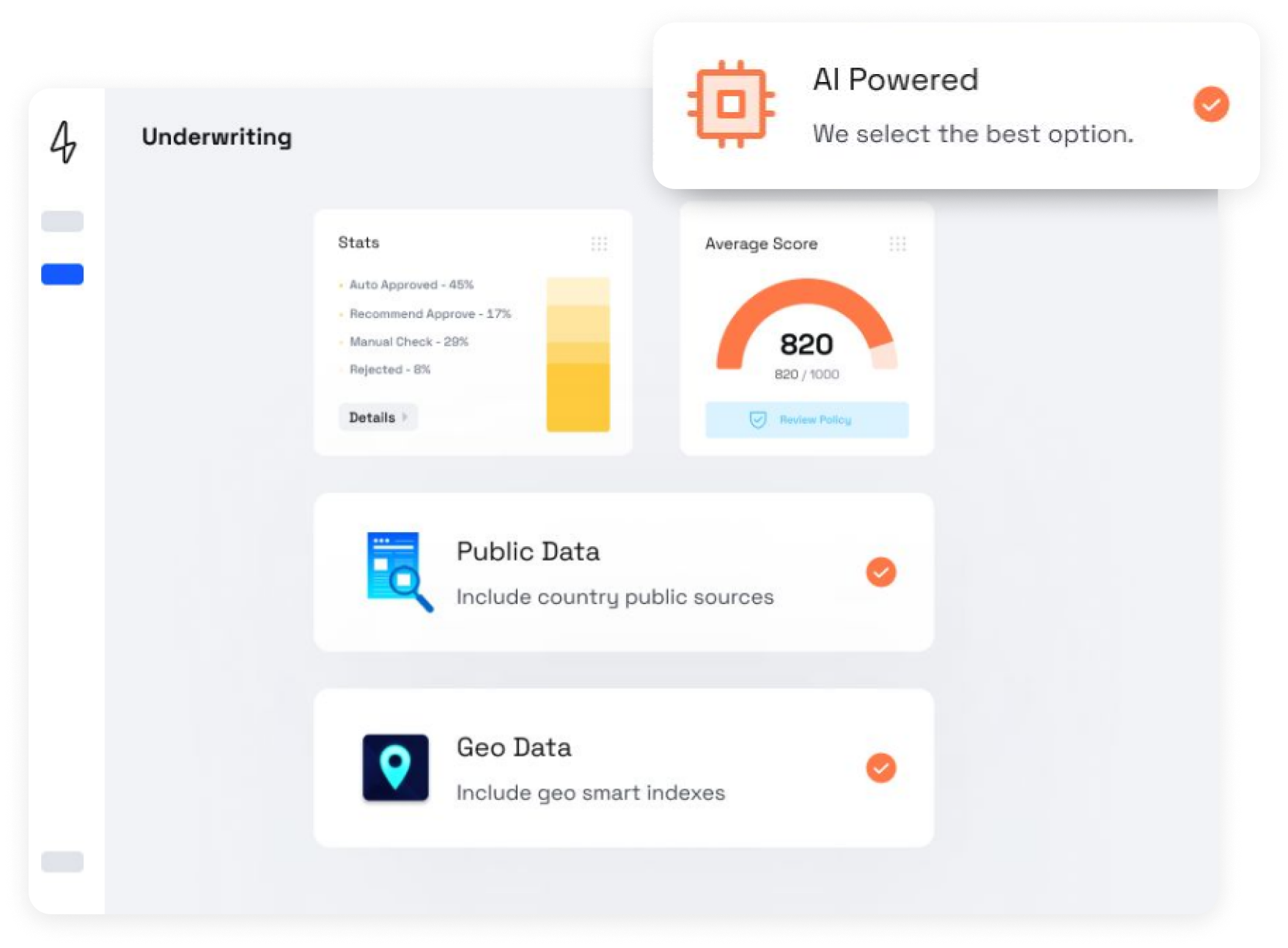

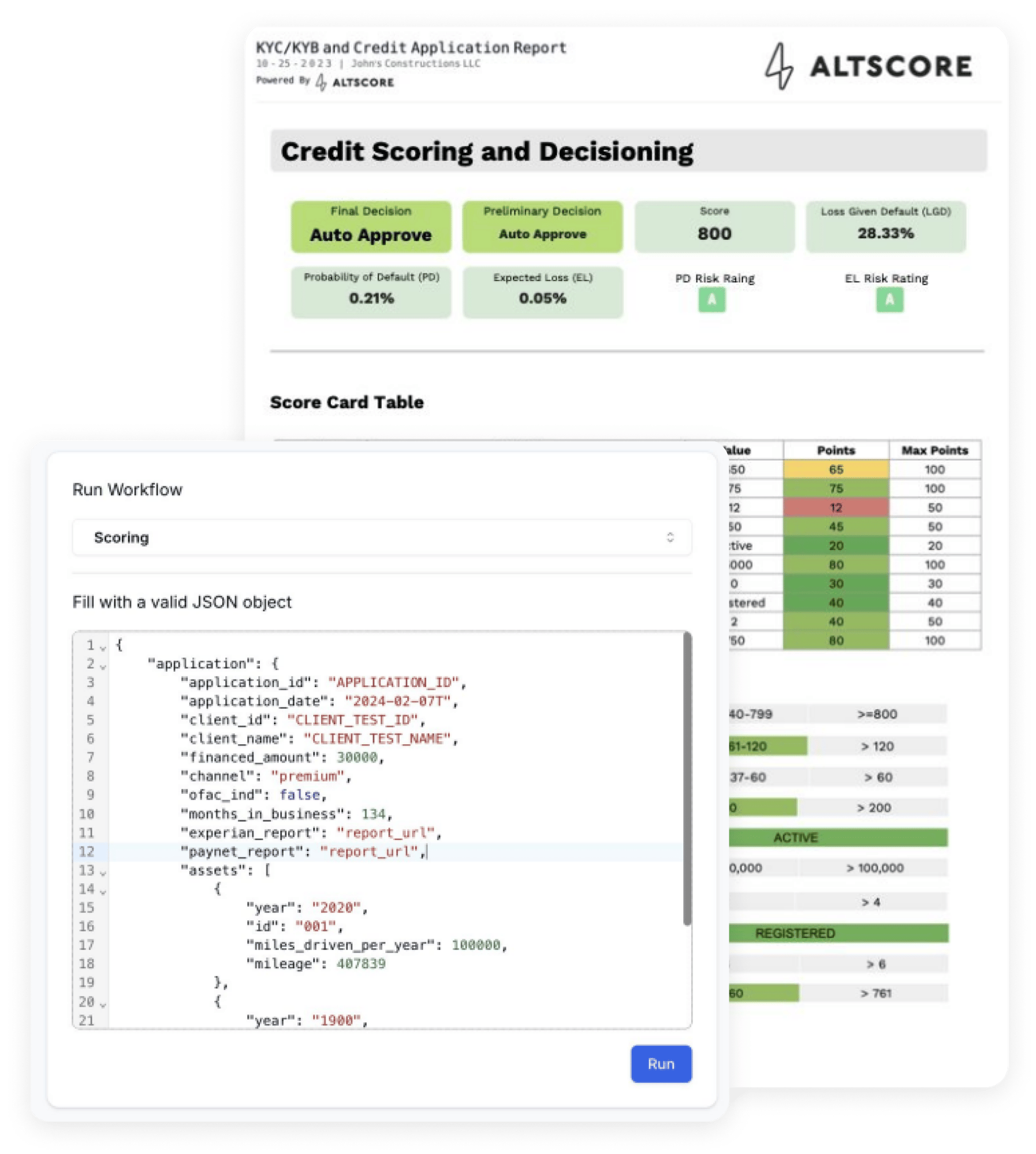

QuipScoring

Real-Time & Instant Underwriting

Make fast, accurate underwriting decisions by leveraging internal and external data. Move closer to touchless lending through seamless API integration or from our intuitive all-in-one lending platform.

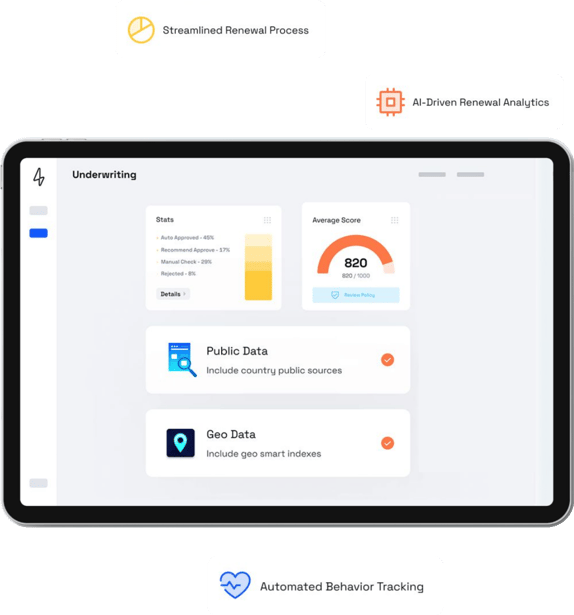

QuipMgmt

Loan Management Made Easy

Stay on top of your portfolio with real-time dashboards and proactive alerts, helping you make informed, actionable decisions.

QuipScoring

Real-Time & Instant Underwriting

Make fast, accurate underwriting decisions by leveraging internal and external data. Move closer to touchless lending through seamless API integration or from our intuitive all-in-one lending platform.

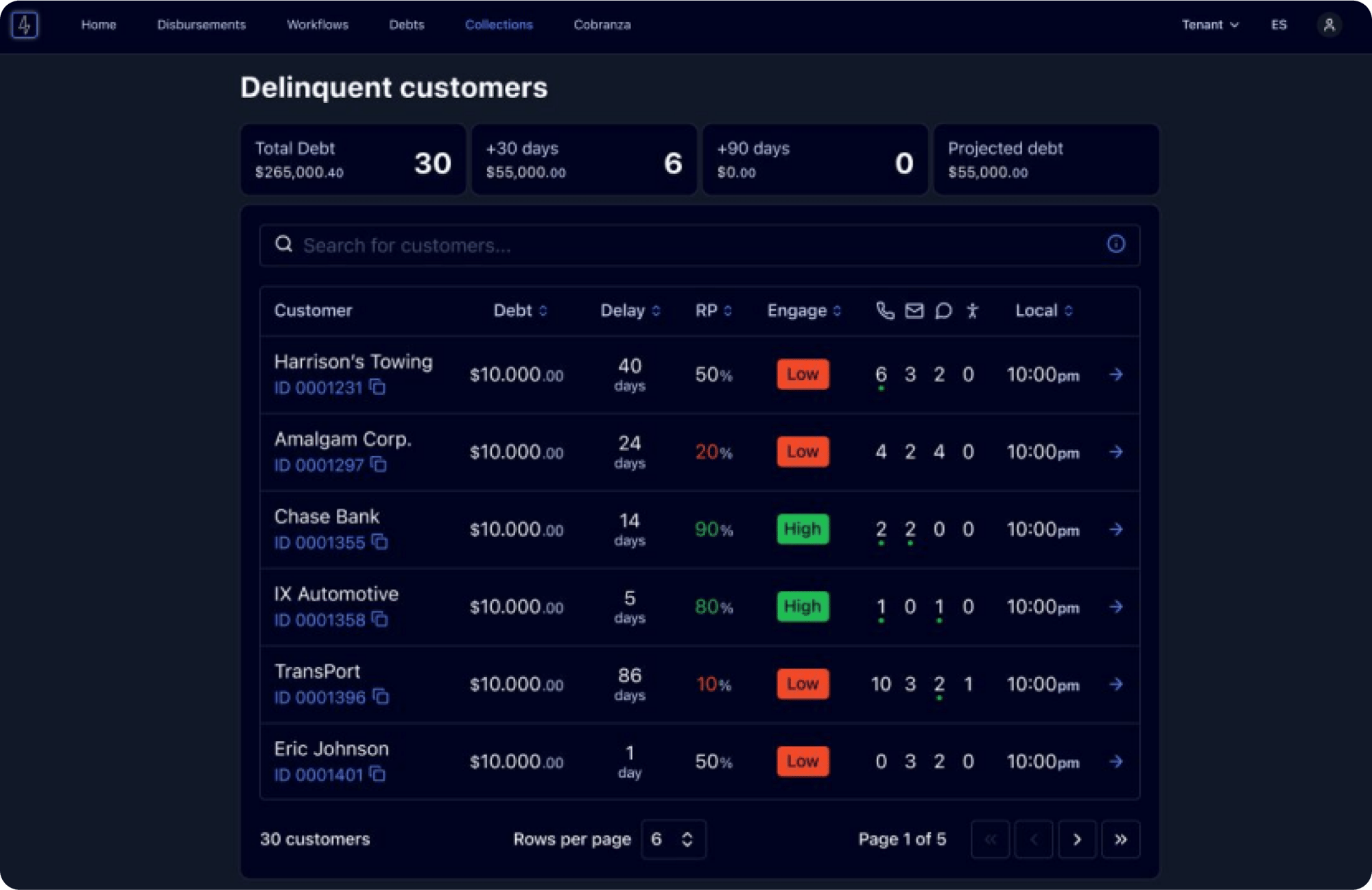

QuipCollect

Data-Driven - Smart Collections

Prioritize collections using real-time client behavior insights. Reduce losses and boost recovery rates with timely, efficient strategies.

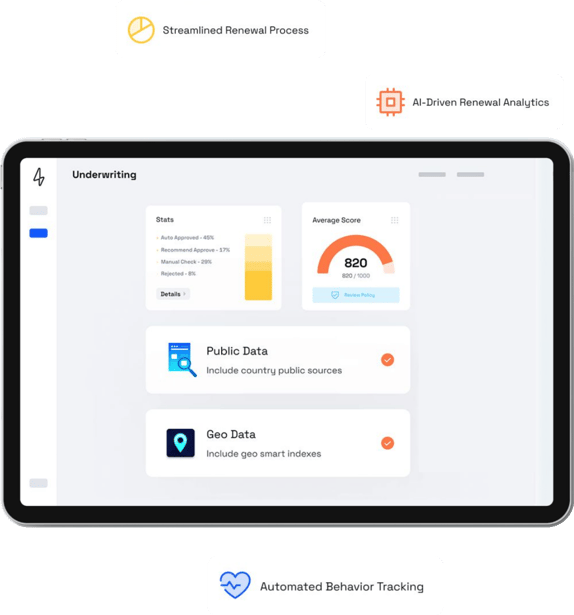

QuipRenew

Automated Renewals

Retain your best clients by automating renewals based on their past behavior. Customize renewal terms to foster long-term relationships.

QuipRenew

Automated Renewals

Retain your best clients by automating renewals based on their past behavior. Customize renewal terms to foster long-term relationships.

Get in Touch

Is the fear of change keeping you stuck in the past? QuipSuite is built to make the transition to AI and data-driven equipment financing seamless. It’s time to let go of the old ways and unlock new potential. Get in touch today and discover how we can guide you to the future of lending.

Londres 241, Piso 4

Juárez, Cuauhtemoc

CDMX

Mexico

4201 Cathedral Ave.

Washington DC 20016

USA

+1 (517) 755-0013